Renovation loans offer the lowest interest rates among the different types of home loans that are available for homeowners or home buyers. What homeowner doesn't dream of renovations? Renovation loans can be a necessity driven by our changing needs or obsolescence. Renovations may be beyond our available funds. Many times, waiting to build funds is not possible or comes at a compromising cost. Financing a renovation becomes a necessity.

There are several financing options available ranging from credit cards to home loans and more. Navigating your financing options can be daunting. The lowest financing is available through your home loan financing. If you have enough equity, the lowest financing is a cash-out refinancing. If you don’t have enough funds, you can consider a renovation loan. Let's see why.

There are several financing options available ranging from credit cards to home loans and more. Navigating your financing options can be daunting. The lowest financing is available through your home loan financing. If you have enough equity, the lowest financing is a cash-out refinancing. If you don’t have enough funds, you can consider a renovation loan. Let's see why.

Renovation Loans

Renovation loans are a generic category of home loans that allows the addition of a renovation budget. A renovation budget is created, and the funds are set aside for a wide array of improvements. These are government back loans are offered by HUD, Fannie Mae, Freddy Mac & VA.

Borrowers will work with general contractors to develop a construction budget. The borrower will also contact a renovation loan specialist to refinance an existing loan or a new loan for purchase. The construction budget is submitted with the loan application. Once funded, escrow closes, the construction will commence. Funds to the construction are released based on percentage of completion.

Borrowers will work with general contractors to develop a construction budget. The borrower will also contact a renovation loan specialist to refinance an existing loan or a new loan for purchase. The construction budget is submitted with the loan application. Once funded, escrow closes, the construction will commence. Funds to the construction are released based on percentage of completion.

Benefits

Let’s consider key benefits of renovation loans:

Low-Interest Financing - For refinancing, renovation loans offer the lowest financing for renovations. These rates are comparable to your home loan. Learn more about your financing options and financing an ADU (Accessory Dwelling Unit).

Low-Interest Financing - For refinancing, renovation loans offer the lowest financing for renovations. These rates are comparable to your home loan. Learn more about your financing options and financing an ADU (Accessory Dwelling Unit).

|

Renovations - offers a wide variety of renovations. From minor improvements, with a minimum budget of $5,000, finished improvements, deferred conditions (new roof, heating/cooling, plumbing) to extensive renovations like adding a master suite or income properties. Deferred conditions can be included like needing a new roof, HVAC, re-plumbing & electrical. Landscaping and even adding new pools are allowable.

|

|

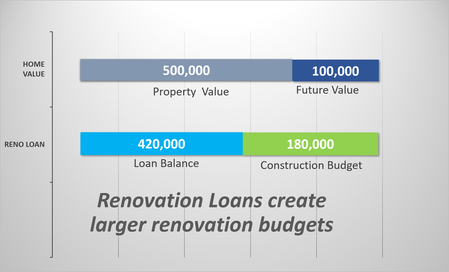

Larger renovation budget - One of the key advantages is the renovation budget is based on the future value of the property that includes the improvements from renovations. Homeowner can implement renovations now to enjoy years to come.

Larger renovation budget - One of the key advantages is the renovation budget is based on the future value of the property that includes the improvements from renovations. Homeowner can implement renovations now to enjoy years to come.