The Benefits of a Renovation Loan

Let's take a closer look at the advantages of a renovation loan. Think Value & Flexibility with the opportunity to enjoy all your home improvements Now for years to come.

Value

Let's take a closer look at the advantages of a renovation loan. Think Value & Flexibility with the opportunity to enjoy all your home improvements Now for years to come.

Value

- The biggest advantage is that you are financing the renovation loan at the same rate as your home loan. This can be the lowest interest rate available for a construction loan.

- Equity can be created through the renovation loan process. When the home equity + construction costs is compared to an appraisal can result in a net equity.

- Uninhabitable properties can be purchase at a discount. Less competition and low investor cash offers can leave room for the savvy home buyers. There will be less interest in properties from buyers looking for "move-in ready" homes. Investors will attempt to purchase these properties at high discounts.

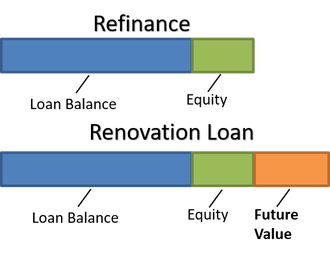

Extend your Loan Amount

Homeowners have desires to improve their home. From deferred conditions, room additions, kitchen remodels to granny flats (ADU)Homeowners are excited to see the possibilities. Renovation extends your loan amount since its based on the future value of the improvements. Once the scope of improvements are determined and costs, an appraiser will determine the future value based on these improvements. The lender will based on the loan amount on this appraisal.

Home owners can now leverage this future value to implement these improvements today!

Homeowners have desires to improve their home. From deferred conditions, room additions, kitchen remodels to granny flats (ADU)Homeowners are excited to see the possibilities. Renovation extends your loan amount since its based on the future value of the improvements. Once the scope of improvements are determined and costs, an appraiser will determine the future value based on these improvements. The lender will based on the loan amount on this appraisal.

Home owners can now leverage this future value to implement these improvements today!

Flexibility

Many are encouraged to learn the flexibility renovation loans offers. Most types of improvements that are fixed are eligible. The program flexibility extends to the types of property.

Improvements

Here is a list of examples:

The flexibility extend to the types of properties that qualify.

Properties

Many are encouraged to learn the flexibility renovation loans offers. Most types of improvements that are fixed are eligible. The program flexibility extends to the types of property.

Improvements

Here is a list of examples:

- Finished improvements - Flooring , painting, windows, cabinets, kitchen and bathroom fixtures

- Deferred conditions - electrical, plumbing, heating/cooling, roof, siding or foundation

- Major renovation for uninhabitable properties requiring complete renovations.

- Room Additions - Master suite including master bedroom/closet & bathroom or other room additions

- Income property additions (up to 3)

- Landscaping including fencing, hardscape & pools(Fannie Mae)

The flexibility extend to the types of properties that qualify.

Properties

- Detached homes

- Condos/townhomes Must be FHA approved properties.

- Manufactured homes (interior only)

- Mix use (Commercial & residential)

NOW

Family needs may change over time. Growing or contracting families. Or your financial security has improved and your suffering without a master bedroom suite. You now have the opportunity of renovating your current property in lieu of having to move to accommodate the changes in your household needs. Moving is always an option. But you may want stay in the school district or the lack of inventory delivers no results. Renovation loans should be considered as a viable alternative.

Family needs may change over time. Growing or contracting families. Or your financial security has improved and your suffering without a master bedroom suite. You now have the opportunity of renovating your current property in lieu of having to move to accommodate the changes in your household needs. Moving is always an option. But you may want stay in the school district or the lack of inventory delivers no results. Renovation loans should be considered as a viable alternative.

- Enjoy your dream home now.

- Putting your equity to work improving your financial security and lifestyle at the same time.