THE PROCESS

The more you learn about these programs will increase your satisfaction and success of creating your next dream home.

The process for renovation loans vary on the following types:

The scope of work, construction costs, and financing evaluation will determine which provider and type that best meet your needs.

The more you learn about these programs will increase your satisfaction and success of creating your next dream home.

The process for renovation loans vary on the following types:

- Limited or Standard

- HUD or Fannie Mae

The scope of work, construction costs, and financing evaluation will determine which provider and type that best meet your needs.

The following are general guides for the standard & limited type loans for a HUD 203K insured loan:

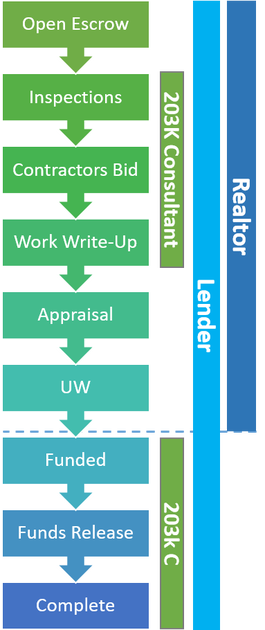

Standard Renovation Loan

The following is a general guideline for a HUD 203K , standard renovation loan. This process may vary based on lender & type.

Process

Inspections - Compliance inspection is required to identify health, safety and deferred conditions.

Secondary inspections may be required like termite , lead paint, sewer video inspection for further evaluation by other trade professionals required by loan and/or consultant. Any of these conditions must be included in the contractor's bid.

Contractor's Bid - Reviewed for compliance. Requires detail including scope of work, itemized labor and material costs. Costs must be commensurate with local market.

Contingency Reserve - A reserve fund is required ranging from 10 - 20% of construction bid total. This is in anticipation of unexpected conditions not evident at the time of inspection such as hidden damage. These may also be allocated for other "upgrades" requested by the client during the construction process.

Work Write-up - Documentation created by consultant that provides a comprehensive overview of project. This is required prior to ordering appraisal. Work write-up is reviewed by underwriting for funding.

Appraisal - Appraisal requires copy of work write-up and value is determined based on the improvements.

Funded - Approved by underwriting and funded. Renovations funds are held in escrow account. Funds are managed by lender's renovation department.

Funds Release - Funds for the construction loan are released and coordinated by the 203K consultant through field draw inspections.

Standard Renovation Loan

The following is a general guideline for a HUD 203K , standard renovation loan. This process may vary based on lender & type.

Process

Inspections - Compliance inspection is required to identify health, safety and deferred conditions.

Secondary inspections may be required like termite , lead paint, sewer video inspection for further evaluation by other trade professionals required by loan and/or consultant. Any of these conditions must be included in the contractor's bid.

Contractor's Bid - Reviewed for compliance. Requires detail including scope of work, itemized labor and material costs. Costs must be commensurate with local market.

Contingency Reserve - A reserve fund is required ranging from 10 - 20% of construction bid total. This is in anticipation of unexpected conditions not evident at the time of inspection such as hidden damage. These may also be allocated for other "upgrades" requested by the client during the construction process.

Work Write-up - Documentation created by consultant that provides a comprehensive overview of project. This is required prior to ordering appraisal. Work write-up is reviewed by underwriting for funding.

Appraisal - Appraisal requires copy of work write-up and value is determined based on the improvements.

Funded - Approved by underwriting and funded. Renovations funds are held in escrow account. Funds are managed by lender's renovation department.

Funds Release - Funds for the construction loan are released and coordinated by the 203K consultant through field draw inspections.

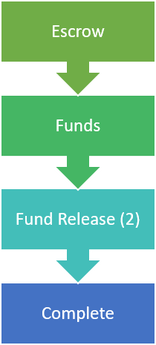

Limited Renovation Loan

This type of loan is designed to simplify the overall process for construction loans under $35,000.

Process

Inspection - Recommend a certified FHA inspector or HUD consultant for an initial home inspection that can identify conditions that must meet HUD's Health & Safety conditions. These conditions must be remedied and included in the construction bid. These conditions will be verified by the FHA appraiser.

Contractor's Bid - Reviewed for compliance. Requires a detailed scope of work, itemized labor and material costs. Costs must be commensurate with local market.

Funded - Approved by underwriting and funded. Renovations funds are held in escrow account. Funds are managed a lender's renovation department.

Funds Release - 35 - 50% Initial funds release at the close of escrow. Balance of funds to be released upon completion of project. It's important to understand that contractors will need working capital for these types of loans.

This type of loan is designed to simplify the overall process for construction loans under $35,000.

Process

Inspection - Recommend a certified FHA inspector or HUD consultant for an initial home inspection that can identify conditions that must meet HUD's Health & Safety conditions. These conditions must be remedied and included in the construction bid. These conditions will be verified by the FHA appraiser.

Contractor's Bid - Reviewed for compliance. Requires a detailed scope of work, itemized labor and material costs. Costs must be commensurate with local market.

Funded - Approved by underwriting and funded. Renovations funds are held in escrow account. Funds are managed a lender's renovation department.

Funds Release - 35 - 50% Initial funds release at the close of escrow. Balance of funds to be released upon completion of project. It's important to understand that contractors will need working capital for these types of loans.

Teamwork

Developing a seasoned team of professionals is critical to the satisfaction and success of your renovation project. Lender - Selection of your lender is recommended as a first starting point. Locate an experienced lender or specialized in renovation loans. Its preferred that they are a direct lender versus a broker. You need to understand what your loan qualification to determine your budget that includes property and renovation costs. Contractor - By far your most important selection in the success of your renovation. Interview several to determine their quality of work, financial, experience with construction loans. Get references, Check Calif. Contractors licensing board to assure license is active and insured. It is recommended to select a contractor as soon as possible. Consultant - Required with most renovation loans, Consultants role is to work in the field with borrower, contractor, lender and realtor in reviewing contractor's bids, preparing loan documents to lenders underwriting for funding. Once funded, consultant assists in releasing funds until completed. Research active HUD 203K consultants that services your area on HUD's website: 203K Roster Realtor - When a purchase is involved, realtors play a vital role. They can assist in property valuations, property search and managing the "selling side". Its real important that expectation are managed with the selling side. Realtors can assist identifying which type of properties are well suited and optimal for renovation loans. Visit our Renovation pages to see how these loans can fulfill a multitude of Real Estate Needs. |

Lender

Consultant

|