Renovation Loan Basics

Renovation loans allows addition of a construction loan to a home loan. This can be for refinance or purchase. These loans were introduced in the 1960's by HUD. Fannie Mae also offers renovation that operates similarly.

HUD & Fannie Mae are US government enterprises offering renovation loans since the 1960's. HUD 203K is a federally insured loan that offers a construction loan for home improvements. This is available for a home purchase or refinancing a home to incorporate construction costs of any residential renovation project. A full range of home improvements are allowed. From finished improvements to major renovations including room additions and adding income properties are allowed. The loan leverages the current equity and future value of improvements.

HUD 203K Renovation Loan

HUD offered since the 1960's to help rebuild blighted neighborhoods. One of the lowest down payments of 3.5%. Requires PMI throughout the life of the loan.

Fannie Mae HomeStyle Loan

Homestyle is modeled after the HUD 203K loan. This process is similar. Purchase requires a minimum of 5% down payment. PMI can be removed about 20% equity.

Purchase

When buying a home, renovation loans only adds more opportunities for you. From freshening a tired looking home with new finishes with new flooring, painting, fixtures and appliances to major additions like adding a master suite, these loans and create your dream home to enjoy years to come.

Refinance

Current homeowners can take advantage of equity in your home and the value in improvements to finance your renovation project. The construction costs will be incorporated into the refinance of your home loan at the same interest rate. There is frankly no comparison to borrow funds for a construction loan.

HUD & Fannie Mae are US government enterprises offering renovation loans since the 1960's. HUD 203K is a federally insured loan that offers a construction loan for home improvements. This is available for a home purchase or refinancing a home to incorporate construction costs of any residential renovation project. A full range of home improvements are allowed. From finished improvements to major renovations including room additions and adding income properties are allowed. The loan leverages the current equity and future value of improvements.

HUD 203K Renovation Loan

HUD offered since the 1960's to help rebuild blighted neighborhoods. One of the lowest down payments of 3.5%. Requires PMI throughout the life of the loan.

Fannie Mae HomeStyle Loan

Homestyle is modeled after the HUD 203K loan. This process is similar. Purchase requires a minimum of 5% down payment. PMI can be removed about 20% equity.

Purchase

When buying a home, renovation loans only adds more opportunities for you. From freshening a tired looking home with new finishes with new flooring, painting, fixtures and appliances to major additions like adding a master suite, these loans and create your dream home to enjoy years to come.

Refinance

Current homeowners can take advantage of equity in your home and the value in improvements to finance your renovation project. The construction costs will be incorporated into the refinance of your home loan at the same interest rate. There is frankly no comparison to borrow funds for a construction loan.

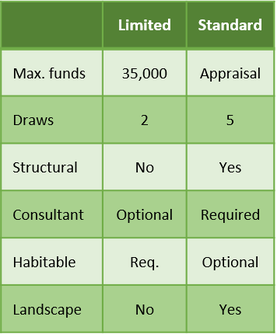

Renovation Loans: Limited or Standard

Renovation loans offers two types: Limited or Standard.

Limited - is a simplified process for renovations under $35,000. This is best suited for renovations that consist of finished types of improvements and deferred conditions. Upon funding of loan, allows two release of funds, Initial and final. There are limitations of these where structural changes or at the discretion of the lender, may require a standard renovation loan. Please consult with an experienced lender or 203K consultant.

Standard - renovation loans are over $35,000. The maximum is determined by FHA loan limits and the appraisal with improvements. This requires services of a HUD 203K consultant to assist in compliance, construction bid and funds release once the loan funds.

Process

There are several options that affect the process of the renovation loan. Here are the following options that determine the loan process:

Please view our HOW page for more details

Renovation loans offers two types: Limited or Standard.

Limited - is a simplified process for renovations under $35,000. This is best suited for renovations that consist of finished types of improvements and deferred conditions. Upon funding of loan, allows two release of funds, Initial and final. There are limitations of these where structural changes or at the discretion of the lender, may require a standard renovation loan. Please consult with an experienced lender or 203K consultant.

Standard - renovation loans are over $35,000. The maximum is determined by FHA loan limits and the appraisal with improvements. This requires services of a HUD 203K consultant to assist in compliance, construction bid and funds release once the loan funds.

Process

There are several options that affect the process of the renovation loan. Here are the following options that determine the loan process:

- Purchase or Refinance

- HUD or Fannie Mae

- Limited or Standard

- Lender

Please view our HOW page for more details

Improvements

The most flexible feature of the renovation program is the range of improvements. Most fixed improvements are allowed.

Types of Property

Renovation Loans flexibility continues with supporting most types of properties:

The most flexible feature of the renovation program is the range of improvements. Most fixed improvements are allowed.

- Repair existing foundation

- Structural alterations

- Wells/septic public water/sewer systems

- Repair/Replace plumbing, heating, AC, electrical, foundation & roof

- Improve functions and modernization

- Aesthetic appeal - Flooring, paint, appliances, cabinets, fixtures

- Energy conservation improvements (mandatory, EEMs)

- Improvements for disability

- Site improvements, landscaping, exterior decks, patios and porches

- Lead based paint remediation

- Adding 1 -3 family structure (must attach)

Types of Property

Renovation Loans flexibility continues with supporting most types of properties:

- Detached single family

- Multi-family up to 4 units

- Condominiums/Townhomes (FHA approved)

- Mix use of residential and commercial

- Manufactured (non structural)

Visit our other links