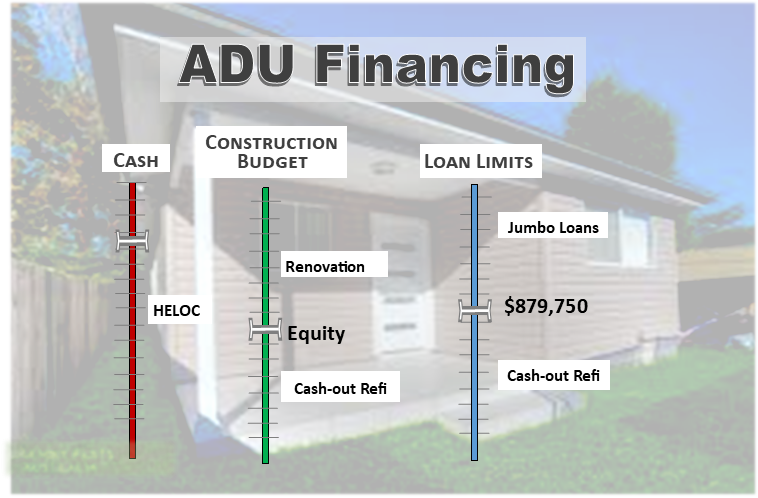

ADU FinancingWe offer a full portfolio of financing solutions to homeowners specifically for renovations. From remodels, room additions, new construction including ADUs.

|

|

Which is the Best Loan for you?

The good news is most homeowners have multiple solutions. Navigating the best solution depends on a multitude of factors: equity, credit, cash flow, available funds, and more. Our consultation will help navigate financing solutions that best meet the needs of each borrower.

Refinance - Cash out

Renovation Loans - HUD, Fannie Mae, VA

|

Renovation loans are available from HUD, Fannie Mae & VA. for property purchase or refinance. These loans allow inclusion of a construction budget to your home loan. These loans offer low financing & low-down payment. One of the biggest advantages is that it creates a larger construction budget based on the future property value.

|

HELOC - Home Equity Line-of-Credit

Construction Loans

|

A financing solution for new construction. Construction costs are paid in completed phases. Two options exist: Construction to Permanent or Construction Only. One of the benefits is these loans offer Interest-only during the time of construction. The monthly payments will increase in line with the progress of the construction. |

Reverse Mortgage

|

Reverse Mortgage or Home Equity Conversion Mortgage (HECM) are government insured loans that provide monthly payout of one-time cash-out lump sum payout based on the home equity. This could be used for home renovations or to build an ADU.

Borrower must be sixty-two or over to qualify. You can still live in the residence without any monthly mortgage payments. You could use the one-time cash payout to build an ADU. You now have additional monthly income to enjoy in your retirement. |

Jumbo Loans