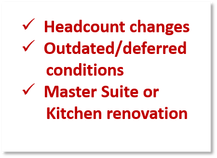

Homeowners may realize over time, changing needs for their home & lifestyle. Growing families or "Empty Nesters" impacts your accommodations. High living costs for the elderly urges alternative living accommodations. You may also have interior needs of outdated, worn furnishings in need of renovation or overdue for a new roof. Then there is that long desire for a master bedroom/bathroom suite or deluxe kitchen.

The costs to accommodate these needs are usually beyond discretionary funds. Renovation loans can be a cost-effective solution. Renovation loans allows homeowners to leverage equity in their current property & future value of the renovation improvements. You will refinance your home to include the renovation costs. In other words, your getting a construction loan at the same rate as your home loan. You will be hard pressed to find cost effective solution

Let's Get Started

Do some homework before you bring on your team. You'll find these initial steps will help your team to better assist and keep the project moving timely.

The following are tasks you may want to initiate before talking to a professional:

Renovation Costs - Develop & define a budget for your renovation costs. Lenders and contractors will want details of scope of work and more importantly a budget. If you're adding a room, master suite, get some ideas of square footage, types of finishes & fixtures. The more you can quantify, the better your team will be able to assist you.

Financial Assessment - Determine your equity. You can estimate value from popular realtor websites. See our Resource page.

Next would be to get balance on your loan This gives an idea of your equity. You may want to consider a Home Equity Line of Credit (HELOC). If your renovation costs can be funded by the cash out equity, that may be cost-effective. One of the drawbacks of HELOC is that are a variable, so your rate will adjust every year that will make you mortgage change annually.

If a HELOC doesn't work, you should then investigate a renovation loan. One advantage of a renovation loan, is the allowance to borrow beyond the current value of your home. The rate on renovation loans are fixed that will provide you a consistent mortgage payment.

The knowledge of your equity and construction costs will be helpful in starting development of your team.

The costs to accommodate these needs are usually beyond discretionary funds. Renovation loans can be a cost-effective solution. Renovation loans allows homeowners to leverage equity in their current property & future value of the renovation improvements. You will refinance your home to include the renovation costs. In other words, your getting a construction loan at the same rate as your home loan. You will be hard pressed to find cost effective solution

Let's Get Started

Do some homework before you bring on your team. You'll find these initial steps will help your team to better assist and keep the project moving timely.

The following are tasks you may want to initiate before talking to a professional:

Renovation Costs - Develop & define a budget for your renovation costs. Lenders and contractors will want details of scope of work and more importantly a budget. If you're adding a room, master suite, get some ideas of square footage, types of finishes & fixtures. The more you can quantify, the better your team will be able to assist you.

Financial Assessment - Determine your equity. You can estimate value from popular realtor websites. See our Resource page.

Next would be to get balance on your loan This gives an idea of your equity. You may want to consider a Home Equity Line of Credit (HELOC). If your renovation costs can be funded by the cash out equity, that may be cost-effective. One of the drawbacks of HELOC is that are a variable, so your rate will adjust every year that will make you mortgage change annually.

If a HELOC doesn't work, you should then investigate a renovation loan. One advantage of a renovation loan, is the allowance to borrow beyond the current value of your home. The rate on renovation loans are fixed that will provide you a consistent mortgage payment.

The knowledge of your equity and construction costs will be helpful in starting development of your team.

Teamwork

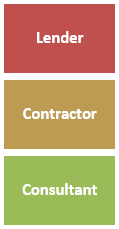

Creation of your team is crucial to the overall success of a renovation loan. Look for experience and synergy in selecting your team. The following is a brief outline. See our Process for more detail:

Creation of your team is crucial to the overall success of a renovation loan. Look for experience and synergy in selecting your team. The following is a brief outline. See our Process for more detail:

- Lender - Experience or specializes in 203K loans. A direct lender is preferred versus a broker. A direct lender can directly process and facilitate this specialized loan.

- Contractor - By far your most important selection in the success of your renovation. Interview several to determine their quality of work, financial, experience with construction loans. Get references.

- Consultant - Required in most renovation loans. They are hired by homeowners that verifies property conditions, construction bid & creates required loan documents. They also manage disbursement of funds to the contractor.

Next Steps

Explore more. Visit our Explained: What, Why, How, Resources

Tips

The following are other important considerations to be aware of:

Explore more. Visit our Explained: What, Why, How, Resources

Tips

The following are other important considerations to be aware of:

- Value - Anticipate value on improvements

- Monitor Loan qualification - Purchase + construction bid = 90% of appraisal

- If property becomes uninhabitable during construction, you can defer mortgage payments during construction.

- PMI - Monitor your property value to anticipate elimination of private mortgage insurance when you have sufficient equity to qualify to refinance.