Housing Crisis is Close to Home

Home-ownership is the foundation of building equity, wealth and comfort.

Home-ownership may be daunting with our housing crisis. In fact we may not have to look beyond our own family to understand the crisis and frustration at all generational levels.

Aging Parents - Are living longer and may be financially unprepared. Some of the costs for assisted living will drain funds prematurely.

Siblings - Without home ownership, struggle with escalating rents making home ownership unattainable.

Young Adults - Our children are frustrated with high monthly rent. This impairs saving for their first home. They be forced to relocate to more affordable areas with much lower housing costs.

Impairments - Family members in need of caregiver assistance need long-term affordable housing and close proximity.

Home-ownership may be daunting with our housing crisis. In fact we may not have to look beyond our own family to understand the crisis and frustration at all generational levels.

Aging Parents - Are living longer and may be financially unprepared. Some of the costs for assisted living will drain funds prematurely.

Siblings - Without home ownership, struggle with escalating rents making home ownership unattainable.

Young Adults - Our children are frustrated with high monthly rent. This impairs saving for their first home. They be forced to relocate to more affordable areas with much lower housing costs.

Impairments - Family members in need of caregiver assistance need long-term affordable housing and close proximity.

Create Affordable Housing with a Granny Flat

|

Accessory Dwelling Units

California enacted recent changes to ADUs, Accessory Dwelling Units in response to the housing crisis experienced throughout California. Also known as granny flats, the statewide mandate changes removed barriers making ADUs viable and more affordable.

|

|

Affordability

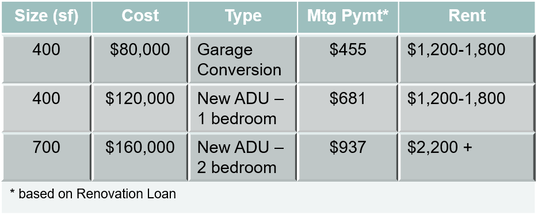

So lets look at examples of affordability. We have three floor plans. We utilize renovation home loans to finance. The loans are available from HUD (203K) and Fannie Mae (Homestyle). This can be for purchase or refinance.

Garage Conversion - Utilizing existing structure greatly reduces construction costs. This will save costs for foundation, framing, siding and more. You still must have off street parking perhaps utilizing the existing driveway for all parking needs.

New Accessory Dwelling Unit - New ADUs can be detached or attached to the main dwelling. You may be able to utilize existing utility services. You need to anticipate setbacks and parking requirements.

The mortgage payment shows the net difference in your mortgage payments that includes the construction costs. This becomes your monthly costs for the ADU.

You'll be able to offer affordable housing for your loved one.

Garage Conversion - Utilizing existing structure greatly reduces construction costs. This will save costs for foundation, framing, siding and more. You still must have off street parking perhaps utilizing the existing driveway for all parking needs.

New Accessory Dwelling Unit - New ADUs can be detached or attached to the main dwelling. You may be able to utilize existing utility services. You need to anticipate setbacks and parking requirements.

The mortgage payment shows the net difference in your mortgage payments that includes the construction costs. This becomes your monthly costs for the ADU.

You'll be able to offer affordable housing for your loved one.

The Process

Serious consideration of adding an ADU requires a team of experienced professionals. Any construction can be daunting and time consuming. You would have to hire lender, architect and contractor to start.

The process starts with financing to determine that a professional lender and evaluate your best options. The Feasibility would entail surveying property, hiring an architect for plans and submission to local building department. The most important selection, will be the contractor.

The process starts with financing to determine that a professional lender and evaluate your best options. The Feasibility would entail surveying property, hiring an architect for plans and submission to local building department. The most important selection, will be the contractor.

Financing

Let's explore ways to finance ADUs. If you don’t available funds to cover construction costs, you can explore financing options leveraging your dwelling.

EQUITY - Homeowners can refinance their current home loan and utilize equity to cover the construction costs.

RENOVATION - If equity is insufficient you can consider a Renovation loan. Renovation loans offer another financing option with the same low rates. The advantage renovations loans offers over an equity loan, is the renovation funds are based on the future improvements.

Other Financing

Construction Loans are another option - These are intended for major renovations or new construction.

You may have assets you can borrow from like stocks or 401K. These have many restrictions like time limits.

We have a financial expert on board. We can make an assessment online

Let's explore ways to finance ADUs. If you don’t available funds to cover construction costs, you can explore financing options leveraging your dwelling.

EQUITY - Homeowners can refinance their current home loan and utilize equity to cover the construction costs.

RENOVATION - If equity is insufficient you can consider a Renovation loan. Renovation loans offer another financing option with the same low rates. The advantage renovations loans offers over an equity loan, is the renovation funds are based on the future improvements.

Other Financing

Construction Loans are another option - These are intended for major renovations or new construction.

You may have assets you can borrow from like stocks or 401K. These have many restrictions like time limits.

We have a financial expert on board. We can make an assessment online

Complimentary Financial Review

We offer a complimentary financial review to explore what financing best meets your needs. This is a no-frills free consultation over the phone Interview. Once complete, we can review side by side comparisons of all financial options.

Once you have narrowed down your financing solution, we can start the loan process. There is no obligation.

Take our No-Frills Financial review

We offer a complimentary financial review to explore what financing best meets your needs. This is a no-frills free consultation over the phone Interview. Once complete, we can review side by side comparisons of all financial options.

Once you have narrowed down your financing solution, we can start the loan process. There is no obligation.

Take our No-Frills Financial review

- No credit pull

- No FICO score

- No application

Feasibility

Once financing has been determined, a Feasibility Study would the next process. This Feasibility would start with a site survey to determine boundary, setbacks, easements and approximate ADU size limits. Other considerations would be utility capacity planning including electrical, gas & water. Plans can then be created. An architecture can assist with survey and plans. The plans can then be reviewed by city building department and contractor. The contractor can build an estimate bid. After approval from building department and feedback from client the contractor can then submit a final construction bid.

Site Survey - Evaluate property boundaries, setbacks and grading. This will identify location of ADU and size.

Capacity Services - Evaluate electrical, gas & water services for the ADU. This involves assessment of your current dwelling services. Initially you should consider utilizing the current dwelling utility services versus having installing new services.

Parking Considerations - Off street parking is not required when an ADU is within 1/2 mile of a public transportation stop. Check your location for public transportation. Google Maps provides public transit options .

Building Department - San Diego area has 18 building departments . Each building department must create a specific ordinance or fall under the States mandate. Contact your local building department. Request information of accessory dwelling units provisioning.

Other Considerations

Owner occupancy - Many local jurisdictions will require owner occupancy in either the main dwelling or ADU. Check with you local building department.

Short term rental restrictions - Many communities including coastal areas will have restrictions like a 30 day minimum. This will impact the resale value of the property.

Hiring Professionals - By far your most important decision. Most of us don't have experience hiring architects and contractors. Be prepared to pay an initial deposit. You may want to consider a design/build firm that will work with you from initial concept to completion.

Once financing has been determined, a Feasibility Study would the next process. This Feasibility would start with a site survey to determine boundary, setbacks, easements and approximate ADU size limits. Other considerations would be utility capacity planning including electrical, gas & water. Plans can then be created. An architecture can assist with survey and plans. The plans can then be reviewed by city building department and contractor. The contractor can build an estimate bid. After approval from building department and feedback from client the contractor can then submit a final construction bid.

Site Survey - Evaluate property boundaries, setbacks and grading. This will identify location of ADU and size.

Capacity Services - Evaluate electrical, gas & water services for the ADU. This involves assessment of your current dwelling services. Initially you should consider utilizing the current dwelling utility services versus having installing new services.

Parking Considerations - Off street parking is not required when an ADU is within 1/2 mile of a public transportation stop. Check your location for public transportation. Google Maps provides public transit options .

Building Department - San Diego area has 18 building departments . Each building department must create a specific ordinance or fall under the States mandate. Contact your local building department. Request information of accessory dwelling units provisioning.

Other Considerations

Owner occupancy - Many local jurisdictions will require owner occupancy in either the main dwelling or ADU. Check with you local building department.

Short term rental restrictions - Many communities including coastal areas will have restrictions like a 30 day minimum. This will impact the resale value of the property.

Hiring Professionals - By far your most important decision. Most of us don't have experience hiring architects and contractors. Be prepared to pay an initial deposit. You may want to consider a design/build firm that will work with you from initial concept to completion.

We Have the Team

Let's get your questions answered. Complete our Next Step Form today to explore the benefits that best meets your needs.