Baby Boomers may be dreading the reality that they may not have sufficient funds to support their retirement. Retirement planning is challenged by maximizing income while containing costs of living. Sadly living longer is overshadowed whether there are sufficient funds for your extended life. Healthcare, mobility and affordable long-term housing needs are paramount and the highest concern.

Retirement income may be comprised of your 401K, pension and social security. As those incomes are fixed, your attention turns to looking at controlling your costs. Housing cost is at the top of the list. The equity in your home may be leveraged in several ways.

Real Estate - One of your assets is equity in your property. Its time to evaluate equity in your property and understand how to utilize it. Its important to recognize how to maximize your asset for your retirement. How to monetize it and protect from potential erosion.

One strategy is to sell, invest your profits(equity) and relocate to more affordable housing geographically. This may conflict with desires to Age-in-Place.

Recent legislation with Accessory Dwelling Units(Granny flats) will create new options to unlock that equity and create a profitable rental income stream. This will be crucial in supplementing income for your retirement.

Retirement income may be comprised of your 401K, pension and social security. As those incomes are fixed, your attention turns to looking at controlling your costs. Housing cost is at the top of the list. The equity in your home may be leveraged in several ways.

Real Estate - One of your assets is equity in your property. Its time to evaluate equity in your property and understand how to utilize it. Its important to recognize how to maximize your asset for your retirement. How to monetize it and protect from potential erosion.

One strategy is to sell, invest your profits(equity) and relocate to more affordable housing geographically. This may conflict with desires to Age-in-Place.

Recent legislation with Accessory Dwelling Units(Granny flats) will create new options to unlock that equity and create a profitable rental income stream. This will be crucial in supplementing income for your retirement.

Accessory Dwelling Units

California enacted recent changes to ADUs, Accessory Dwelling Units (Granny Flats) in response to the housing crisis experienced throughout California. Also known as granny flats, the statewide mandate changes removed barriers making ADUs viable and more affordable.

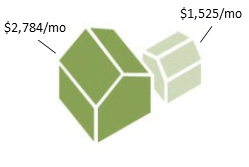

ADUs can present a couple of opportunities. A baby boomer can add an ADU to create rental income to supplement retirement .

- Rent out you current dwelling to maximize rental income by downsizing into the new ADU.

- Alternatively, you can rent the new ADU to create supplemental rental income.

ADU creates an advantageous opportunity to unlock and leverage that home equity to create additional income stream desperately needed for retirement.

Other benefit would be to Age-in-Place. Staying close to local family members, familiar resources to healthcare & shopping.

Other benefit would be to Age-in-Place. Staying close to local family members, familiar resources to healthcare & shopping.

The Process

Serious consideration of adding an ADU requires a team of experienced professionals. Any construction can be daunting and time consuming. You would have to hire lender, architect and contractor to start.

The process starts with financing to determine that a professional lender and evaluate your best options. The Feasibility would entail surveying property, hiring an architect for plans and submission to local building department. The most important selection, will be the contractor.

The process starts with financing to determine that a professional lender and evaluate your best options. The Feasibility would entail surveying property, hiring an architect for plans and submission to local building department. The most important selection, will be the contractor.

Financing

Let's explore ways to finance ADUs. If you don’t available funds to cover construction costs, you can explore financing options leveraging your dwelling.

EQUITY - Homeowners can refinance their current home loan and utilize equity to cover the construction costs.

RENOVATION - If equity is insufficient you can consider a Renovation loan. Renovation loans offer another financing option with the same low rates. The advantage renovations loans offers over an equity loan, is the renovation funds are based on the future improvements.

Other Financing

Construction Loans are another option - These are intended for major renovations or new construction.

You may have assets you can borrow from like stocks or 401K. These have many restrictions like time limits.

We have a financial expert on board. We can make an assessment online

Let's explore ways to finance ADUs. If you don’t available funds to cover construction costs, you can explore financing options leveraging your dwelling.

EQUITY - Homeowners can refinance their current home loan and utilize equity to cover the construction costs.

RENOVATION - If equity is insufficient you can consider a Renovation loan. Renovation loans offer another financing option with the same low rates. The advantage renovations loans offers over an equity loan, is the renovation funds are based on the future improvements.

Other Financing

Construction Loans are another option - These are intended for major renovations or new construction.

You may have assets you can borrow from like stocks or 401K. These have many restrictions like time limits.

We have a financial expert on board. We can make an assessment online

Feasibility

Once financing has been determined, a Feasibility Study would the next process. This Feasibility would start with a site survey to determine boundary, setbacks, easements and approximate ADU size limits. Other considerations would be utility capacity planning including electrical, gas & water. Plans can then be drawn. An architecture can assist with survey and plans. The plans can then be reviewed by city building department and contractor. The contractor can build an estimate bid. After approval from building department and feedback from client the contractor can then submit a final construction bid.

Site Survey - Evaluate property boundaries, setbacks, grading. This will identify location of ADU and size.

Capacity Services - Evaluate electrical, gas & water services for the ADU. This involves assessment of your current dwelling services. Initially you should consider utilizing the current dwelling utility services versus having installing new services.

Parking Considerations - Off street parking is not required when an ADU is within 1/2 mile of a public transportation stop. Check your location for public transportation. Google Maps provides public transit options .

Building Department - San Diego area has 18 building departments . Each building department must create a specific ordinance or fall under the States mandate. Contact your local building department. Request information of accessory dwelling units provisioning.

Other Considerations

Owner occupancy - Many local jurisdictions will require owner occupancy in either the main dwelling or ADU. Check with you local building department.

Short term rental restrictions - Many communities including coastal areas will have restrictions like a 30 day minimum. This will impact the resale value of the property.

Hiring Professionals - By far your most important decision. Most of us don't have experience hiring architects and contractors. Be prepared to pay an initial deposit. You may want to consider a design/build firm that will work with you from initial concept to completion.

Once financing has been determined, a Feasibility Study would the next process. This Feasibility would start with a site survey to determine boundary, setbacks, easements and approximate ADU size limits. Other considerations would be utility capacity planning including electrical, gas & water. Plans can then be drawn. An architecture can assist with survey and plans. The plans can then be reviewed by city building department and contractor. The contractor can build an estimate bid. After approval from building department and feedback from client the contractor can then submit a final construction bid.

Site Survey - Evaluate property boundaries, setbacks, grading. This will identify location of ADU and size.

Capacity Services - Evaluate electrical, gas & water services for the ADU. This involves assessment of your current dwelling services. Initially you should consider utilizing the current dwelling utility services versus having installing new services.

Parking Considerations - Off street parking is not required when an ADU is within 1/2 mile of a public transportation stop. Check your location for public transportation. Google Maps provides public transit options .

Building Department - San Diego area has 18 building departments . Each building department must create a specific ordinance or fall under the States mandate. Contact your local building department. Request information of accessory dwelling units provisioning.

Other Considerations

Owner occupancy - Many local jurisdictions will require owner occupancy in either the main dwelling or ADU. Check with you local building department.

Short term rental restrictions - Many communities including coastal areas will have restrictions like a 30 day minimum. This will impact the resale value of the property.

Hiring Professionals - By far your most important decision. Most of us don't have experience hiring architects and contractors. Be prepared to pay an initial deposit. You may want to consider a design/build firm that will work with you from initial concept to completion.

We Have the Team

The complexity of homeowner to navigate the travails of financing, surveying, plans and selecting the contractors will have pitfalls that can cost you more and block your endeavors.

We have a team of professionals to assist every step of the way. From a free initial consultation to financing, planning to construction, we have a coordinated process and an experienced team every step of the way.

We have a team of professionals to assist every step of the way. From a free initial consultation to financing, planning to construction, we have a coordinated process and an experienced team every step of the way.