|

This post focuses on how SB9 impacts the San Diego area. There are two references that helps understand how SB9 will impact the San Diego area. Please review City of San Diego presentation below and review The Terner report below. Some of the information was extracted specifically for the San Diego market. California recently approved legislation to allow the addition of a second dwelling and a lot-split on a property zoned for single family dwellings. Known as SB9 will go into effect in 2022. Local building departments will need to incorporate these state mandates into the local zoning ordinance Please note these references are not formalized. The Terner report was released prior to final approval of SB9, and the City of San Diego presentation has not been adopted. Please use this information for planning and budgeting purposes. We are actively monitoring SB9 progress for the San Diego area. So, stay tuned. City of San Diego SB9 Presentation - Dec. 21'

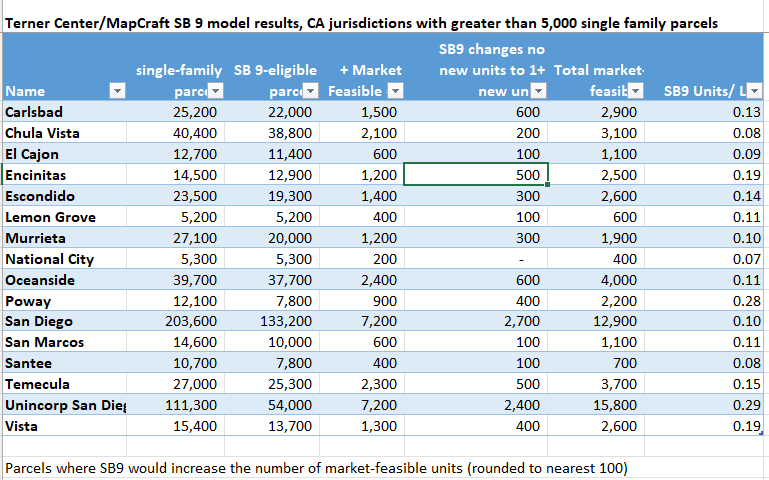

Terner Study of SB9

Terner analysis SB9 for San Diego County

0 Comments

|

AuthorWill Johnson is a HUD Certified 203K Consultant since 2008. Will actively manages loans from HUD & Fannie Mae throughout San Diego & Riverside County. Archives

February 2023

Categories |

We Can Help

|

Our specialty is financing with focus and expertise on construction financing. We have a full portfolio and a process to identify financing that best meets your needs and goals.

Our years of experience have developed firsthand knowledge and relationships of the full range of professionals needed in construction. We developed a team approach of highly coordinated and compatible resources to assist in feasibility, survey, design, permit process and build to the final product.

|

RSS Feed

RSS Feed