|

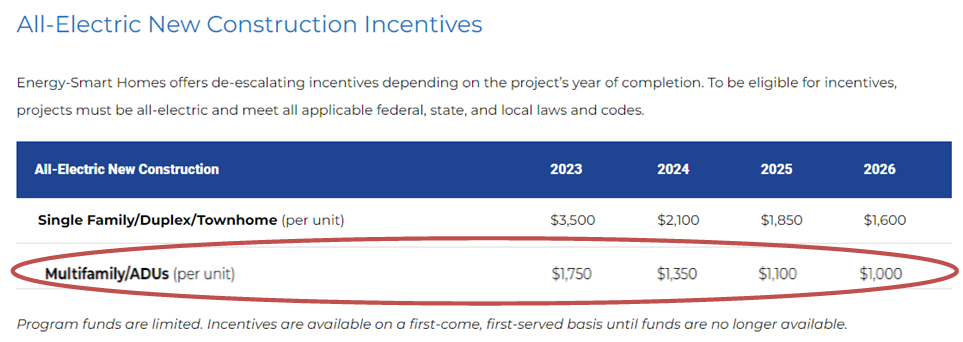

State funds through the Energy Smart Homes All-Electric program offers new incentives for new construction with an All-Electric design. This includes all new construction, including multi-family, single family and ADUs. Funds are limited.

For more information please visit : CA. Energy Smart Homes.

0 Comments

Baby Boomers need all the income they can earn. Learn how to finance and build an ADU with a lump-sum payout in the Reverse Mortgage.

ADU - Granny Flat Benchmark Mortgage is excited to support enrolling borrowers for the CalHFA ADU Grant program. Two significant changes: Grant was expanded from $25,000 to $40,000, maximum income levels have been increased. Income limits range: $139,000 - $248,000 based by county. Requires use of loans containing fund-control like renovation loans: HUD 203k or Fannie Mae Homestyle. Demand and interest is strong. There's anticipation of grant reserves completed being completed & closed. It's encouraged to initiate the consultation. Apply Today. Schedule your Consultation.

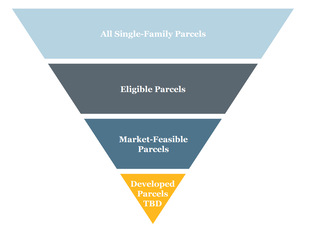

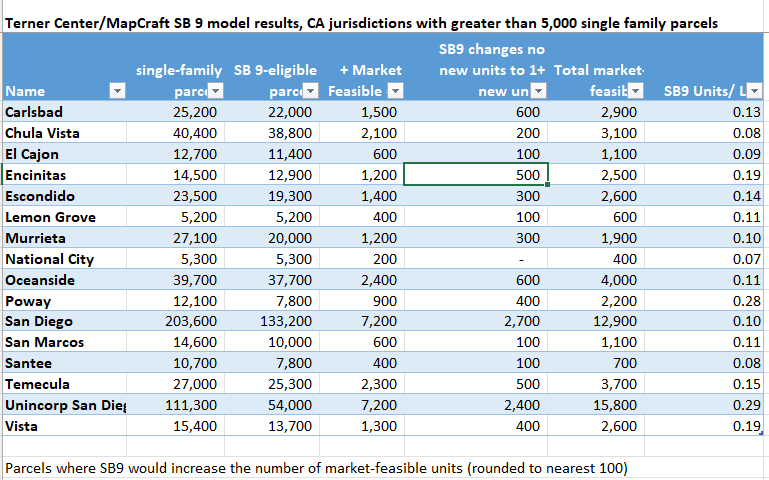

This post focuses on how SB9 impacts the San Diego area. There are two references that helps understand how SB9 will impact the San Diego area. Please review City of San Diego presentation below and review The Terner report below. Some of the information was extracted specifically for the San Diego market. California recently approved legislation to allow the addition of a second dwelling and a lot-split on a property zoned for single family dwellings. Known as SB9 will go into effect in 2022. Local building departments will need to incorporate these state mandates into the local zoning ordinance Please note these references are not formalized. The Terner report was released prior to final approval of SB9, and the City of San Diego presentation has not been adopted. Please use this information for planning and budgeting purposes. We are actively monitoring SB9 progress for the San Diego area. So, stay tuned. City of San Diego SB9 Presentation - Dec. 21'

Terner Study of SB9

Terner analysis SB9 for San Diego CountyWill Johnson, ADU Advisor wants to talk to an expert to understand how to explore and evaluate investing in ADUs. Will speaks with a real estate investor, contractor and broker all in one. The numbers get exciting when you utilize proper depreciation. Learn more Will Johnson, ADU advisor interviews an expert on un-permitted granny flats. Understand the exposure with fines & penalties, the new ADU Amnesty Ordinance and how to correct. 2019 Calif. Energy Efficiency Code is a game changer for new construction, room additions over 700 sf and ADUs. Think solar, more insulation and IAQ Fans.

The following are excerpts from recent amendments to Calif Law effective Jan. 01, 2020 regarding creation of ADUs and Junior ADUs. Legislation are from the following bills: SB 13, AB 68, AB 881.

Join us this Saturday to hear from your State leaders and local experts on latest legislation that removed barriers to enable building ADUs and making it more affordable.

Drop by our booth to learn about financing, see pre-designed plans and renderings. To register: SDCIA website |

AuthorWill Johnson is a HUD Certified 203K Consultant since 2008. Will actively manages loans from HUD & Fannie Mae throughout San Diego & Riverside County. Archives

February 2023

Categories |

||||||||||||||||||||||||||||||||

We Can Help

|

Our specialty is financing with focus and expertise on construction financing. We have a full portfolio and a process to identify financing that best meets your needs and goals.

Our years of experience have developed firsthand knowledge and relationships of the full range of professionals needed in construction. We developed a team approach of highly coordinated and compatible resources to assist in feasibility, survey, design, permit process and build to the final product.

|

RSS Feed

RSS Feed