|

Attached article suggest millennials avoid fixer-uppers preferring move-in ready. My experience as real estate service provider in the field every day with buyers doing home inspections & renovation loans is not the same. The perfect move-in home with all the buyer's desires is frankly rare. I wish there were some statistics on the percentage of home buyers that do some finish renovations prior to move in. It's prevalent with my clients. Many want to add their finished tastes while the property is vacant. New flooring and interior paint, scrub off the popcorn ceiling, remove dining room top the list. Savvy buyers look for worn properties to buy at a discount find a reasonable reliable contractor and utilize a renovation loan from HUD or Fannie Mae. These buyers are excited to select their finishes to enjoy for years to come. See our Before & After projects: Before & After Webpage

Link to Article: Nobody’s Buying Fixer-Uppers Anymore, But Here’s Why They Should

2 Comments

Good insight on market stats that provides ideas and strategies to create home-ownership to service millennial's and the Hispanic communities. Important trends on creating more solutions to renovation financing, technology trends and innovation. An important read for realtors and lenders.

New Changes to ADU OrdinancesSeveral bills were signed yesterday by governor Newsom that will have important benefits in building ADUs

The construction of accessory dwelling units (ADUs) can also help cities meet their housing goals and increase the state’s affordable housing supply. The Governor signed the following bills to eliminate barriers to building ADUs:

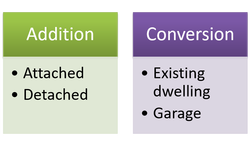

Mike Avery with Instant Guest Homes is featured with modular tiny homes or ADUs. They can drop in your back yard starting at $90,000 minus hookups and permit fees. San Diego's Channel 10 News Feature article We don't have to look far to feel the housing crisis. Retiring parents, siblings, adult children may be struggling to control and manage housing costs. New ADU ordinances and renovation loans can enable homeowners to build ADUs on their current properties for their loved ones. Here is an alternate strategy of leveraging real estate equity and enjoying Aging in Place. Inspection Perfection Published by Will Johnson · 1 hr · Accessory Dwelling Units are getting traction. Great example in North Park. A step forward to our housing crisis while creating equity and income.  California passed law in 2017 and then updated in 2018 improving the addition of ADU (granny flats). This was driven by local building codes impairing effectiveness and a statewide housing shortage affecting many metropolitan areas. Homeowners can create these additions for family members, or create income to offset mortgage payments or more. Renovation loans allows addition of income properties. This can be the most cost-effective financing available. There are limitations to the type ADU additions. The ADU must attach or through conversion of utilize existing structure. This could be a garage conversion. The following is a general guide. You must get specific detail with the local building department and hire an architect as the initial process.  Types of ADU New, Attached - Allows new addition up to 50% of square footage of existing dwelling, not greater than 1,200 sf. New, Detached - Allows new addition up to 50% of square footage of existing dwelling, not greater than 1,200 sf. Conversion, Unconditioned - Typically a garage conversion. Conversion, Conditioned - Converting living area. Must have separate outside access and setback that complies with fire safety code.  New ADU Featured Changes Parking - Parking requirements has been of the biggest obstacle in implementing ADUs. The new provision allow more flexibility with location and setbacks restrictions. Allowance for tandem parking and eased setback restriction. The biggest difference is the elimination of off-street parking if the dwelling is within 1/2 mile of public transportation.  Utilities - Not required to have new connections for utilities including electrical, gas, water & sewer. This results in significant savings.  Permit & Connection Fees - Past connection fees reflect costs as a new residential construction. Fees must now be proportional. Another significant price reduction. Other Considerations Fire Sprinkler - Not required if not existing in current dwelling. Local Adoption - Although state mandates are mandatory, some local building departments have yet change their local code to reflect these requirements. There may be additional restriction or requirements. Check with your local department. Owner Occupancy - There may be requirements of owner-occupancy in primary or ADU. This will impact future sale of dwelling. Short Term Rentals - Some local jurisdiction will have restriction of conditions for short term rental. It is imperative to check with your local building department for a complete understanding of ADUs. The past local restrictions impaired many ADU projects. The new allowances will go a long way to make ADUs viable. The cost savings are significant in the tens of thousands of dollars. This is a great time to evaluate an ADU addition. Local News on ADUs SD HIGH EXPENSE 10 NEWS Channel 10 recently reported high connection fees may still be inhibiting the viability of implementing ADUs. San Diego is clearly not keeping track with other Calif. metropolitan Cities. City Council is slow walking rolling back fee reductions. https://www.10news.com/news/fees-on-granny-flat-construction-holding-up-city-efforts-to-fight-housing-crisis?page=2 5/8//2018 San Diego responds with high permit/connection fees for ADUS http://www.lesardevelopment.com/category/adus/ Chula Vista NBC NEWS CV council members are making efforts to align state ADU mandate. This includes aggressive fee reductions. Also considering home occupancy requirement. https://www.nbcsandiego.com/news/local/Chula-Vista-City-Council-Mulls-Granny-Flat-Rule-Change-479293373.html |

AuthorWill Johnson is a HUD Certified 203K Consultant since 2008. Will actively manages loans from HUD & Fannie Mae throughout San Diego & Riverside County. Archives

February 2023

Categories |

||||||

We Can Help

|

Our specialty is financing with focus and expertise on construction financing. We have a full portfolio and a process to identify financing that best meets your needs and goals.

Our years of experience have developed firsthand knowledge and relationships of the full range of professionals needed in construction. We developed a team approach of highly coordinated and compatible resources to assist in feasibility, survey, design, permit process and build to the final product.

|

RSS Feed

RSS Feed